This page brings together all Edexcel A-Level Economics past paper questions focused on business costs, revenue, and cost curve analysis. We compiled these questions by systematically reviewing Edexcel’s published past papers and extracting every question that requires students to calculate, explain, or diagram business costs and revenue.

These questions appear primarily in Paper 1 (Microeconomics) but are also relevant for longer evaluative questions in Papers 2 and 3, where cost and revenue analysis is often used to support written answers. An answer key is available as a downloadable PDF at the bottom of this page to support self-marking and revision.

How business costs and revenue are examined in Edexcel A-Level Economics

Edexcel frequently tests students on their understanding of fixed costs, variable costs, marginal costs, and average costs, alongside total, average, and marginal revenue. Many questions also require you to interpret or draw cost and revenue diagrams, particularly when analysing firm behaviour under different objectives such as profit maximisation or revenue maximisation.

If you are revising business behaviour more broadly, you may also find it useful to practise questions from the Market Structures topic and Business Costs and Revenue–related elasticity questions, which frequently overlap with pricing and revenue analysis.

How to revise cost and revenue questions effectively

Questions on business costs and revenue range from short calculation tasks to diagram-based explanations and extended responses where cost curves are used to support evaluation. Strong answers show clear working, accurate definitions, and correctly labelled diagrams.

Many students practise these questions alongside broader microeconomic past paper collections, such as Edexcel A-Level Economics Past Paper Questions on Business Costs and Revenue within Theme 1 and longer evaluative questions found in Edexcel A-Level Economics Past Paper 25-marker Questions.

How to use this page

This resource is designed to let you target one specification area at a time, saving you from searching through full exam papers. You can use the questions below for timed practice, calculation drills, or diagram revision, before checking your answers against the official mark schemes.

All questions reproduced below remain the intellectual property of Pearson Edexcel and are used here for educational purposes only.

Question 1: Edexcel A-Level Economics 9EC0 November 2021 Paper 1

Patrick Street Productions produces musicals. Its latest production is ‘It’s a Wonderful Life’ and the total cost of this production is $200 000. The ticket price is $40. The theatre has a capacity of 300 seats. The company aims for revenue maximisation. If this is achieved, revenue from ticket sales will cover 30% of total costs. Charitable donations contribute 12.5% towards total cost and a government subsidy ensures the production covers all of its costs.

(a) Calculate the total revenue from ticket sales for ‘It’s a Wonderful Life’, assuming it is shown only five times, all at full capacity. You are advised to show your working. (2 points)

(b) Calculate the value of the government subsidy necessary for this production to cover all of its costs. (2 points)

(c) Which one of the following conditions is necessary for revenue maximisation to occur? (1 point)

A Average revenue equals average cost

B Average revenue equals marginal cost

C Marginal revenue equals average revenue

D Marginal revenue equals zero

Question 2: Edexcel A-Level Economics 9EC0 November 2020 Paper 1

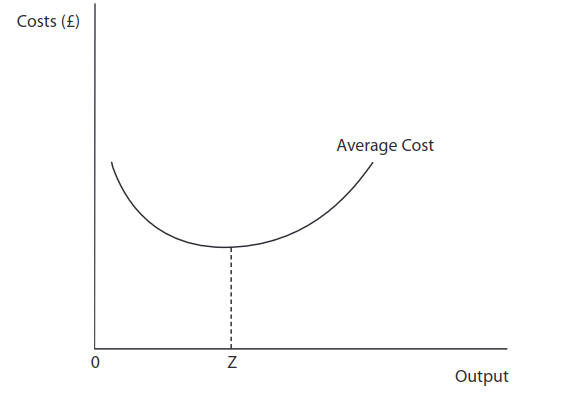

The following illustrates the daily average cost curve for a doughnut producer:

(a) Explain what happens to total cost at output levels greater than Z. (2 points)

(b) At output levels greater than Z, which one of the following correctly identifies what will happen to the cost? (1 point)

Average fixed cost Average variable cost Marginal cost

A Falls Falls Rises

B Falls Rises Rises

C Rises Rises Falls

D Rises Rises Rises

(c) For a luxury doughnut producer the average selling price is £2. The average variable cost is 40% of the selling price and its fixed cost per day is £300. Calculate total costs per day assuming it produces 400 doughnuts per day. (2 points)

Question 3: Edexcel A-Level Economics 9EC0 June 2019 Paper 1 – 5 points

According to the Royal Mail, more hair and beauty salons opened on UK high streets last year than any other type of independent business, with a net increase of 10%, representing 626 new salons.

(a) The UK hair and beauty industry is an example of monopolistic competition because: (1 point)

A firms spend nothing on advertising and research

B the industry is dominated by a few large firms

C the products are homogenous

D there are low barriers to entry and exit

(b) Draw a cost and revenue diagram to show the long-run equilibrium of a firm in monopolistic competition. (4 points)

Question 4: Edexcel A-Level Economics 9EC0 June 2019 Paper 1

In 2016, the insurance group Esure undertook a demerger with its GoCompare price comparison website.

(a) The most likely reason for this demerger was to: (1 point)

A benefit from external economies of scale

B benefit from internal economies of scale

C focus more on its core business

D increase its market share

Following the demerger, GoCompare announced in 2017 a profit of £17.5 million, up 21.5% on 2016. Total revenue in 2017 was £75.8 million, up 4.1% on 2016.

(b) Calculate, using the information provided, the total costs of GoCompare in 2016. (4 points)

Question 5: Edexcel A-Level Economics 9EC0 June 2018 Paper 1

The number of individual weekly ticket sales from UK National Lottery games operated by Camelot was 73 million in the financial year 2015–2016.

The sale price of each lottery ticket was £2. This figure included 24 pence of tax revenue on each ticket sold.

(a) Calculate the weekly revenue received by Camelot after paying the tax to the government. You are advised to show your working. (2 points)

Research conducted for HMRC estimated the cross elasticity of demand for using gaming machines to be 1.28 in response to changes in the price of national lottery tickets.

In October 2013 Camelot increased the price of a national lottery ticket from £1

to £2.

(b) Explain the likely impact of the price increase of national lottery tickets on the

demand for using gaming machines. (2 points)

In 2016 a coastal flood defence scheme was completed at Broomhill Sands in Kent, protecting people, homes and businesses. A £30 million grant from the National Lottery paid for the scheme.

(c) The most likely reason for this grant is to ensure the: (1 points)

A exclusivity of Broomhill Sands

B provision of a private good

C provision of a public good

D rivalry of Broomhill Sands

Question 6: Edexcel A-Level Economics 9EC0 June 2018 Paper 1

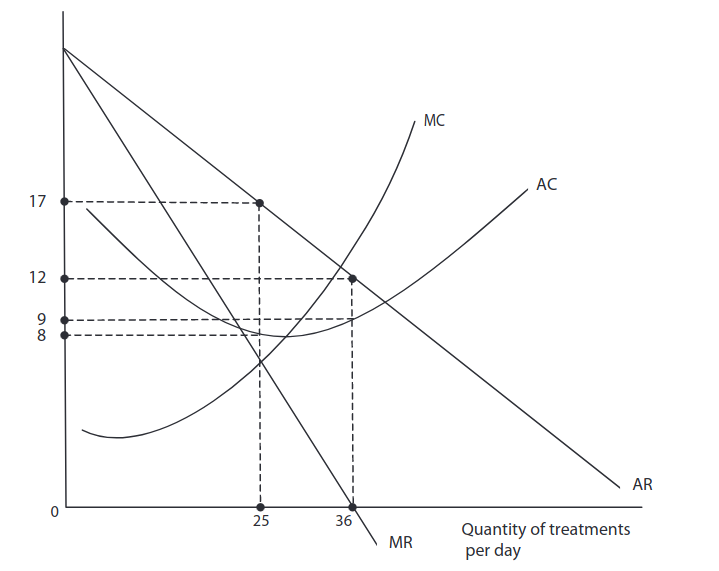

Emily owns and operates a nail ink salon. The diagram shows the cost and revenue curves for treatments at her nail ink salon. Initially, Emily sets her price to maximise profits.

Costs, Revenue

per treatment (£)

(a) Calculate the change in total supernormal profit if Emily changes her objective from profit maximisation to revenue maximisation. You are advised to show your working. (4 points)

(b) Emily now decides to change her objective from revenue maximisation to sales maximisation. This change will lead to: (1 point)

A a decrease in the number of customers

B a decrease in the price of treatments

C an increase in productive efficiency

D an increase in the level of profit

Question 7: Edexcel A-Level Economics 9EC0 June 2017

Between 2010 and 2015 the average price of tea in the UK increased from £7.20 per kilo to £8.48 per kilo. Over the same period the quantity of tea purchased fell from 97 million kilos to 76 million kilos.

(a) Assume that the change in the quantity of tea purchased was only caused by the change in the price of tea. Calculate the price elasticity of demand for tea in response to the rise in its price. You are advised to show your working. (2 point)

(b) Calculate the change in total sales revenue for UK tea retailers between 2010 and 2015. You are advised to show your working. (2 points)

(c) Estimates for the demand for black tea in the UK suggest that it is an inferior good. This implies it has a negative: (1 point)

A cross elasticity of demand

B income elasticity of demand

C price elasticity of demand

D price elasticity of supply

Question 8: Edexcel A-Level Economics 9EC0 June 2017 Paper 1

In 2015 JCB, the construction equipment manufacturer, experienced a 6% fall in revenue. This resulted from a reduction in sales of construction equipment to emerging markets.

(a) Draw a cost and revenue diagram to show the likely impact of a reduction in sales

of construction equipment on JCB’s profits. (4 points)

In India JCB has a strong brand image and a 50% share of the market for construction equipment. This means the construction equipment market in India is likely to have a low level of: (1 point)

A concentration

B contestability

C private ownership

D specialisation

Question 9: Edexcel A-Level Economics 9EC0 June 2017 Paper 1

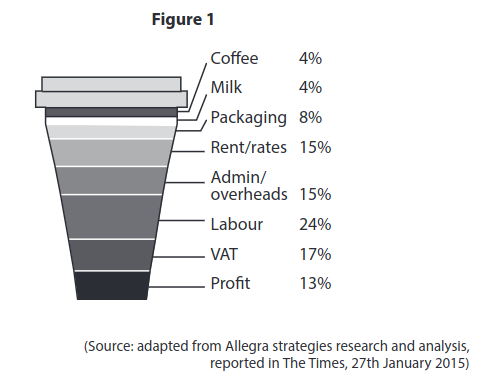

Figure 1 shows the distribution of the revenue received from the sale of a Starbucks cappuccino drink priced at £2.27 in 2015.

(a) Which one of the following is a fixed cost to Starbucks? (1 point)

A Coffee

B Milk

C Packaging

D Rent

(b) Explain the difference between fixed costs and variable costs. (2 points)

(c) With reference to Figure 1, calculate the profit (in pence) for a cappuccino drink.

You are advised to show your working. (2 points)

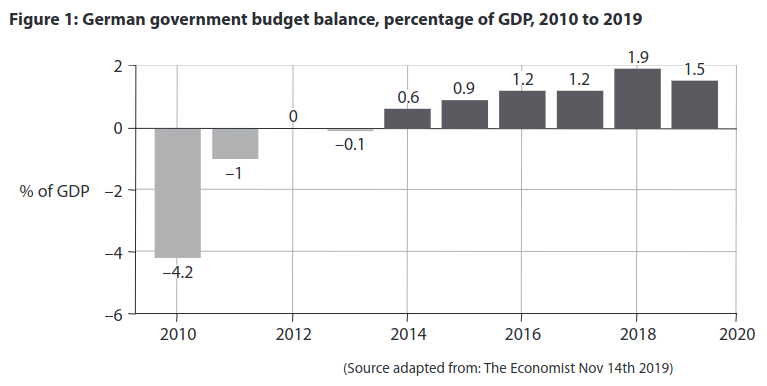

Question 10: Edexcel A-Level Economics 9EC0 November 2021 Paper 3

Extract C

Why Germany keeps to budget rules despite a slowdown in growth

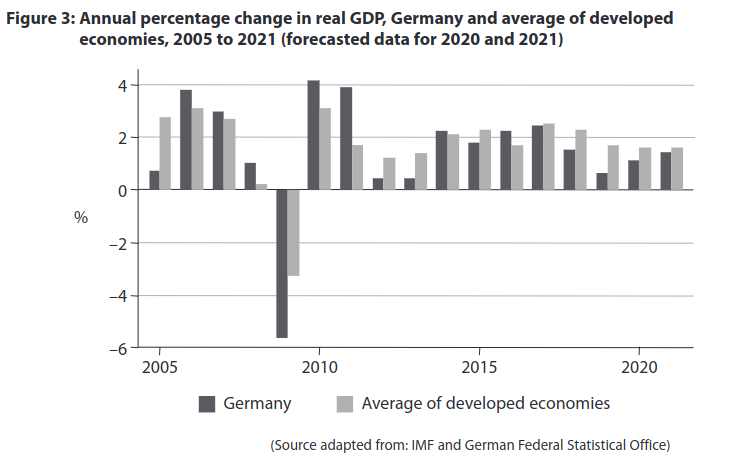

Germany’s economic boom is over, as it has entered recession. During the last ten years of economic growth well over 4 million jobs were created. The fear of recession has revived a debate in Germany: should the government spend more to stimulate growth? It is written into the German constitution that the fiscal deficit cannot be greater than 0.35% of GDP, once the effects of the economic cycle have been removed. Germany’s budget has been in surplus since 2014 and the government is always reluctant to increase spending which would create a deficit. In 2018, aided by booming employment and low interest costs on existing debt, the budget ran to a surplus 1.9% of GDP.

Germany’s main trading partners have long been angered by German fiscal policy. The French President criticised Germany’s budget and current account surpluses that “always occur at the expense of others”.

Large parts of Germany’s infrastructure need significant investment. As the economy has slowed, a decision to run a balanced-budget policy has become harder to defend. In wealthy regions of Germany, crumbling schools have been closed for fear of collapse, and information and mobile technology on a wide scale needs to be modernised. The World Economic Forum reported that accessibility of fibre optic broadband also “remains the privilege of the few”. However, private sector firms, such as major motor manufacturers, are still willing to invest in new technology and the profitability of some of these firms, in the long run, benefits as a result.

The state development bank puts Germany’s investment shortfall at €138 billion (£120 billion). Arguments for a much more expansionary fiscal policy have failed to influence government policy. Big government programmes, such as a recent package to reduce Germany’s carbon emissions, are only implemented when they satisfy fiscal rules.

Extract D

Germany drops to number 7 in the Global Competitiveness Index

Despite being the largest economy in the European Union, Germany’s competitiveness is declining, according to the World Economic Forum (WEF). Germany dropped four places in the WEF’s Global Competitiveness Index, coming in as the seventh-most competitive economy. Out of the 103 indicators used in the report, Germany received lower scores in 53 areas in 2019.

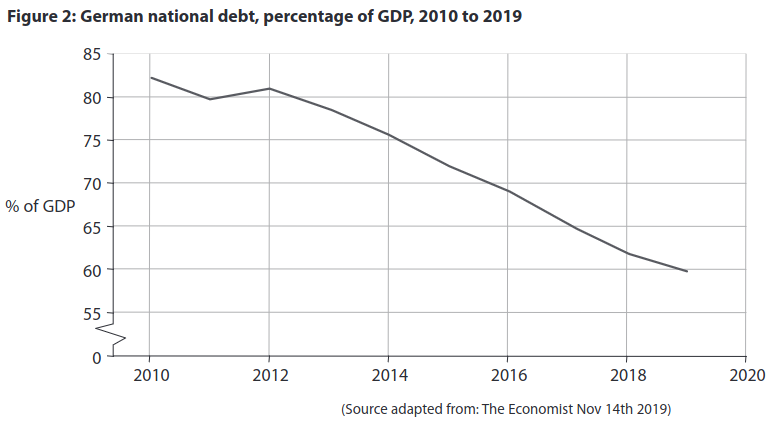

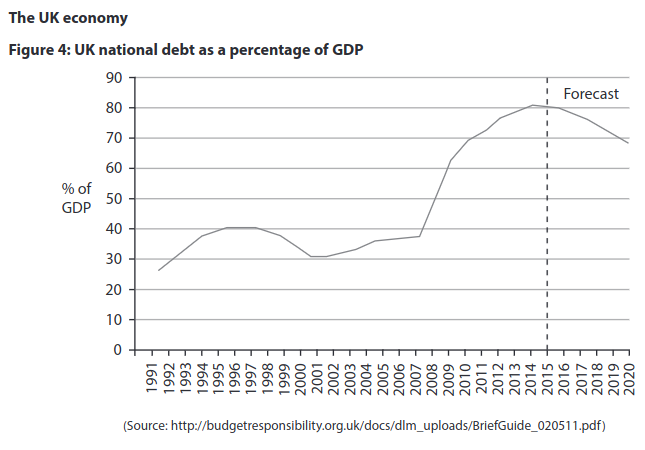

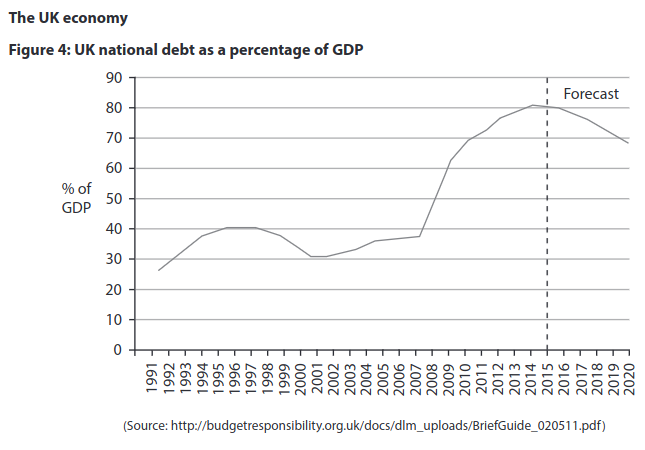

(a) Explain one reason why a country such as Germany wants to avoid an increase in the national debt relative to GDP (Figure 2). (5 points)

(b) Examine two likely effects of the forecast change in the rate of unemployment between 2019 to 2020, on firms in Germany. Refer to Figure 4 in your answer. (8 points)

(c) Discuss the likely impact of investment in new technology on the profitability of firms in Germany, as described in Extract C line 20. Use a cost and revenue diagram to support your answer. (12 points)

EITHER

(d) Evaluate the microeconomic and macroeconomic factors which are likely to determine the rate of economic growth in Germany relative to other developed economies. (25 points)

OR

(e) Evaluate the microeconomic and macroeconomic impacts of ‘a much more expansionary fiscal policy’ (Extract C line 23) on the German economy. (25 points)

Question 11: Edexcel A-Level Economics 9EC0 November 2020

Extract D

The end of the High Street?

Homebase, the UK’s second‑largest do‑it‑yourself (DIY) retailer, made £20–40 million a year profit up to 2016. The Australian conglomerate Wesfarmers bought Homebase for £340 million in 2016, and began to rebrand 24 stores under its own name. It scaled back on curtain, cushion and other homeware sales in favour of power tools and building materials.

In 2018 Wesfarmers sold the DIY chain for £1, in the face of “extremely challenging” market conditions and excess store space. The chain was bought by restructuring specialist Hilco, which had also rescued the music chain HMV in 2013, and the stores have gone back to using the Homebase name. Over 70% of Homebase stores are currently losing money and the new owner wants to exit loss‑making stores and agree to rent reductions, as sales fell 10% in 2018. Homebase has gone back to popular products and brands dropped by its previous owner Wesfarmers.

The closures will add to the mounting job losses on Britain’s high streets. About 25 000 jobs have gone in the first seven months of 2018, according to analysis by an economics thinktank. A further 8 300 jobs are under threat at suppliers, with the multiplier effect meaning that GDP is £1.5 billion less than projected.

Several Marks & Spencer clothing stores closed their doors for the last time as the high‑street chain pushes ahead with a transformation plan. It plans to close 100 stores by 2022. Toys R Us, Poundworld and Maplin have shut down completely, while New Look, Mothercare and Carpetright have plans to close hundreds of stores as losses rise sharply.

Increasing rents and higher business rates have occurred at the same time as falling consumer confidence. Meanwhile, House of Fraser employees and pensioners are nervously awaiting more details about their future. The £90 million rescue deal by Sports Direct, the sportswear chain controlled by Mike Ashley, will protect 16 000 jobs for the time being.

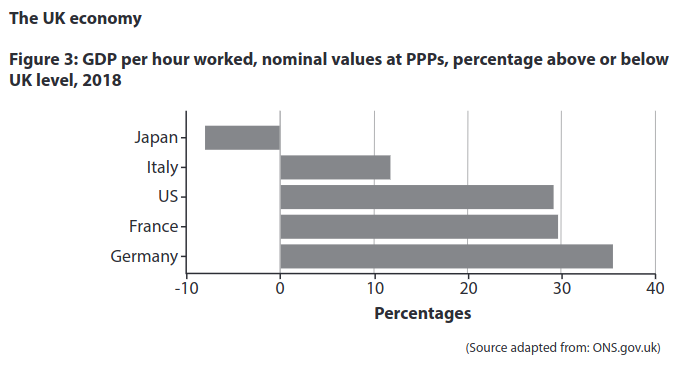

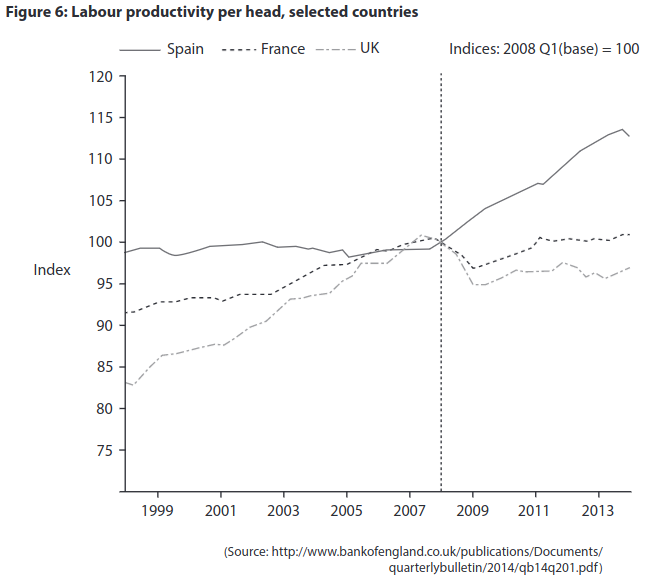

(a) With specific reference to Figure 3, explain why productivity is measured by ‘GDP per hour worked, nominal values at PPPs’. (5 points)

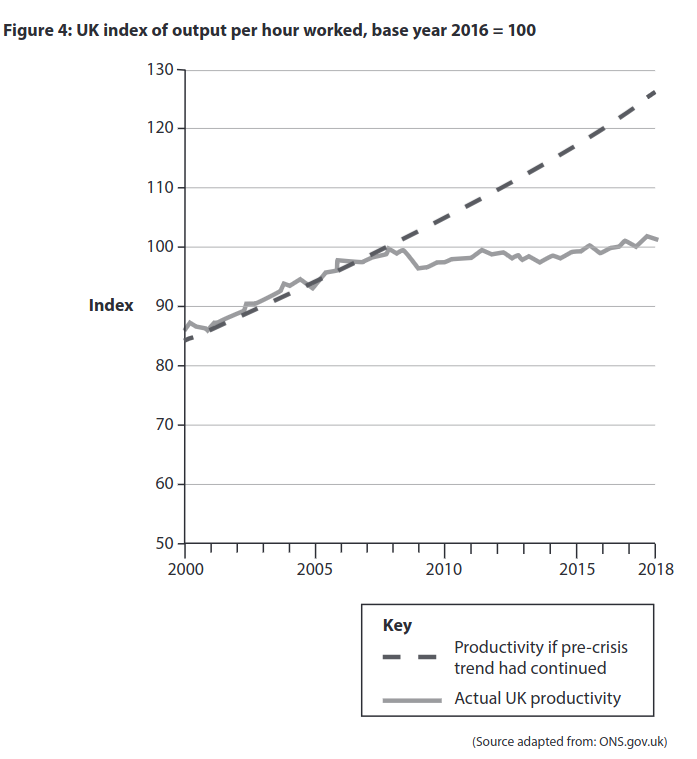

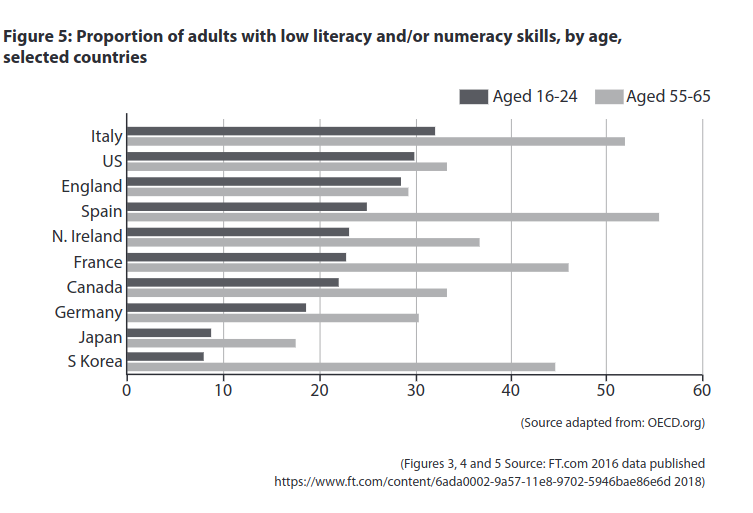

(b) Apart from literacy and numeracy skills in young workers, examine one reason for the trend in productivity in the UK, over the period shown in Figure 4. (8 points)

(c) Discuss factors that are causing many high street retailers in the UK to close some branches or shut down completely. Use a cost and revenue diagram to support your answer (12 points).

EITHER

(d) Evaluate possible microeconomic and macroeconomic policies which could be used to improve UK competitiveness. (25 points)

OR

(e) Evaluate the microeconomic and macroeconomic effects of a decline in the literacy and numeracy skills of a country’s young workers. (25 points)

Question 12: Edexcel A-Level Economics 9EC0 June 2017 Paper 3

Extract C

The National Living Wage (NLW)

The Government has announced that from 2016 it will introduce a Living Wage Premium that will apply on top of the National Minimum Wage (NMW) for employees aged 25 and over to deliver a National Living Wage (NLW) for those people. The main NMW will continue to be set for all employees aged 21 and over, so that those aged 21 to 24 will continue to be subject only to that rate.

The effective minimum wage for the 25+ age group will therefore be over 13% higher in 2020 than would otherwise have been the case, and result in a 0.3% increase in wage costs overall. Further impacts on real GDP are estimated to be higher productivity (+0.3%) but lower average hours worked (-0.2%) and higher unemployment. Overall real GDP is forecast to fall by 0.1% as a result of the NLW. However these forecasts depend on estimates of the likely elasticity of demand for labour.

Academic evidence suggests that changes to the NMW since 1999 have led to only limited effects on demand for labour in the UK. The types of work that will be affected are relatively labour intensive, which may limit the scope for firms to substitute toward using capital. Firms may also be expected to shift demand in favour of the under-25s given that they will not be subject to the NLW, which all else being equal would lead to a smaller reduction in overall labour demand. Some of the reduction in employees could also be partially offset by a rise in self-employment. But increasing the NLW to a higher proportion of median earnings may lead to bigger effects than have been experienced in the past.

Extract D

The productivity puzzle in the UK

Since the onset of the 2007–2008 financial crisis, labour productivity growth in the UK has been exceptionally weak. Despite some modest improvements in 2013, whole-economy output per hour remains around 16% below the level implied by its pre-crisis trend. Even taking into account possible measurement issues and changes in the size of the service sector, this shortfall is large and is often referred to as the ‘productivity puzzle’.

Measures of productivity can be used to inform estimates of an economy’s ability to grow without generating excessive inflationary pressure, which makes understanding recent movements important for the conduct of monetary policy. During the initial phases of the recession, companies appear to have acted flexibly by holding on to labour and lowering levels of capacity utilisation in response to weak demand conditions. But the protracted weakness in productivity and the strength in employment growth over the past two years suggest that other factors are likely to be having a more persistent impact on the level of productivity. These factors are reduced investment in both physical and intangible capital, such as innovation and training, and failings in the labour market such as immobility of labour and under-employment of skilled workers. Some economists explain this by using the concept of an output gap.

(a) With reference to Extract D (line 18), explain the meaning of the term ‘output gap’. Use an aggregate demand and aggregate supply diagram in your answer. (5 points)

(b) With reference to Figures 4 and 5 and your own knowledge, examine the relationship between the national debt as a proportion of GDP and the fiscal deficit. (8 points)

(c) Discuss the likely impact of the National Living Wage on the profitability of firms. Use a cost and revenue diagram in your answer. (12 points)

EITHER

(d) With reference to the information provided and your own knowledge, evaluate the likely microeconomic and macroeconomic influences on the UK’s international competitiveness. (25 points)

OR

(e) With reference to the information provided and your own knowledge, evaluate the microeconomic and macroeconomic effects of a government policy of cutting public expenditure rather than raising taxes as a means of reducing a fiscal deficit. (25 points)

Mark is an A-Level Economics tutor who has been teaching for 6 years. He holds a masters degree with distinction from the London School of Economics and an undergraduate degree from the University of Edinburgh.