This page brings together Edexcel A-Level Economics past paper questions on recessions, financial crises, and debt crises. All questions have been selected from official Edexcel examination papers and organised to support focused revision of macroeconomic instability, policy responses, and financial system risk.

These questions commonly appear in Paper 2 and Paper 3, particularly in contexts involving monetary policy, financial regulation, capital flows, and sovereign debt.

What is the Edexcel A-Level Economics course?

Edexcel A-Level Economics is a qualification taken by students in the final two years of secondary education in the UK. The course is designed to develop students’ ability to analyse economic data, evaluate policy trade-offs, and apply economic theory to real-world contexts.

The specification is set by Pearson Edexcel, the UK’s largest examination board. While similar courses are offered by AQA, OCR, Eduqas, and Cambridge International, this page focuses exclusively on questions set under the Edexcel specification.

Where did we get these Edexcel A-Level recession and financial crisis questions?

The questions on this page were compiled by reviewing all publicly available Edexcel A-Level Economics past papers under the current specification. We identified every question that directly addresses recessions, financial instability, banking crises, sovereign debt, or macroeconomic policy responses, and collected them into a single revision resource.

This allows students to practise exam-style questions on economic downturns and crises in one place, rather than searching across multiple exam papers.

If you are revising other parts of the course, you can find a complete topic index here.

What is a recession?

A recession is a sustained period of economic contraction, meaning that an economy’s real output is falling. Economic output is measured using gross domestic product (GDP), and the most widely accepted definition of a recession is two consecutive quarters of negative economic growth.

Because a quarter is a three-month period, this implies at least six months of economic contraction. Recessions can be caused by a wide range of factors, including:

- financial crises

- supply-side shocks

- high inflation

- collapses in investment or confidence

The specific cause does not determine whether a recession is occurring. The defining feature is falling real GDP.

Recessions are a core focus of Edexcel questions on aggregate demand, unemployment, and macroeconomic policy, particularly in extended essay questions.

What is a financial crisis?

A financial crisis is a period of severe disruption to the financial system, typically involving a collapse in the value of financial assets, a loss of confidence in banks or financial institutions, and threats to overall economic stability.

Financial crises are often characterised by:

- bank failures or near-failures

- liquidity shortages

- sharp falls in asset prices

- reduced lending and credit availability

Major historical examples include the Great Depression, the 2008 Global Financial Crisis, and the European sovereign debt crisis.

Financial crises frequently trigger recessions by undermining investment, restricting credit, and reducing consumer and business confidence. As a result, they are closely linked to questions on quantitative easing, financial regulation, and government intervention.

Students revising related topics may also find it useful to practise questions on:

- Trade, exchange rates, and capital flows (Edexcel A-Level Economics Past Paper Questions on Trade and Currency)

- Macroeconomic policy trade-offs (Edexcel A-Level Past Paper Questions on Trade-Offs Between Macroeconomic Objectives)

What is a debt crisis?

A sovereign debt crisis occurs when a government is unable to meet its debt obligations. In practical terms, this means the government cannot make the required interest or principal payments on its borrowing.

Governments typically borrow to cover the gap between public spending and tax revenue, but debt becomes problematic when investors lose confidence in a country’s ability to repay. This can lead to:

- rising borrowing costs

- capital flight

- currency depreciation

- requests for external financial assistance

Debt crises are frequently examined in Edexcel questions involving the IMF, bailouts, and fiscal sustainability, particularly in the context of developing or emerging economies.

What is a Debt Crisis?

A sovereign debt crisis is the inability of a government to service their debt obligations. In laymans terms, this means that a government cannot meet the minimum payments on its debt. Governments commonly borrow money in order to make up the difference between government spending and tax revenue.

Question 1: Edexcel A-Level Economics 9EC0 November 2021 Paper 2

The European Central Bank introduced a new round of quantitative easing (QE) in March 2020, purchasing up to €750 billion of assets. The objective of this QE was to reduce the serious risks to the effectiveness of monetary policy resulting from a significant recession. The European Central Bank’s target for inflation remains at ‘below but close to 2%’.

Evaluate the effectiveness of quantitative easing during ‘a significant recession’. (25 points).

Question 2: Edexcel A-Level Economics 9EC0 May 2019 Paper 2

In 2018, the International Monetary Fund (IMF) lent Argentina $57 billion as part of a bailout package to help prevent the country’s government defaulting on its debts. This financial crisis also caused significant capital flight out of Argentina’s economy.

(a) Explain the role of the IMF in providing financial assistance to countries such as Argentina. (4 points)

(b) Which one of the following is most likely to happen to Argentina’s currency value as a result of capital flight, assuming it is operating with a floating exchange rate system? (1 point)

A Appreciation

B Depreciation

C Devaluation

D Revaluation

Question 3: Edexcel A-Level Economics 9EC0 May 2019 Paper 2

Extract A

UK companies use forward currency market

The Norfolk-based picture frames maker Nielsen Bainbridge recently made forward contracts in the foreign exchange market to reduce the impact of currency fluctuations. The pound’s post-Brexit referendum depreciation has been a test of nerve for Nielsen Bainbridge and many other importers. At present the company’s suppliers are located in Europe or China. “Currency therefore has a big impact on our business and the margins we can obtain,” says Ms Burdett, the Finance Director. Forward contracts enable institutions, businesses and individuals to lock in an exchange rate over a certain period of time regardless of how the rate moves during that time. Ms Burdett buys currency as soon as Nielsen Bainbridge confirms a large order as a way to fix costs. One third of UK business managers are considering shifting from EU to UK suppliers.

Extract B

Bank of England seeking to prevent future bank bailouts

The Bank of England has ordered big lenders in the UK to find £116 billion of funding to ensure that taxpayers will never again have to bail out the banking sector. The Bank intends to publish details of how each of the big lenders would cope in the event they find themselves in a situation similar to Royal Bank of Scotland and Lloyds Banking Group, which needed £65 billion of taxpayer bailouts during the 2008 Global Financial Crisis. This had a significant negative impact on the UK government’s national debt and, many would argue, increased the need for contractionary fiscal policy. Having said that, the UK government sold all its shares in Lloyds Banking Group in 2017 and, according to the Chancellor of the Exchequer, “recovered every penny of its investment in Lloyds”. Sir Jon Cunliffe, the deputy governor at the Bank responsible for financial stability, said regulators needed to let banks fail in a similar way that traditional companies collapse. This has not been possible in the past because of the risk that savers lose their money and because a system did not exist to allow banks to be put into insolvency. “Just like when other businesses fail, losses arising from bank failure would be imposed on shareholders and investors. This protects the public from loss and incentivises banks to operate more prudently,” said Cunliffe.

Extract C

Bank of England tells lenders to increase capital reserves

The Bank of England has told lenders they will need to build a special reserve worth £11.4 billion by the end of 2018 as it tries to make banks more resilient to the risk posed by mounting consumer debt. This reserve of assets that can be readily turned into cash is a way of forcing banks to set aside capital reserves in good times in order to keep lending to the wider economy at a steady level, even during an economic downturn. In 2017 the Bank of England told UK banks it would raise the reserve ratio, relative to all assets, from zero to 0.5% and also forecast a further increase to 1% by the end of 2017. The move is not intended to directly reduce consumer demand for credit, which in 2017 grew by 10.3% on an annual basis, but it may well lead to banks becoming less willing to lend to consumers. Since the Bank of England has recently become increasingly concerned about consumer borrowing, including rising car loans and credit card debt, this may be no bad thing as far as the Bank of England is concerned, even if it does have a negative impact on the wider economy. Analysts are concerned about the impact on consumer confidence of rising inflation, partly caused by a falling pound. With falling real incomes consumers could become more vulnerable to falling behind with their credit card and personal loan repayments. Despite these concerns, the UK economy recently recorded the lowest rate of unemployment since 1975.

(a) With reference to Extract A, explain the role of forward markets in currencies. (5 points)

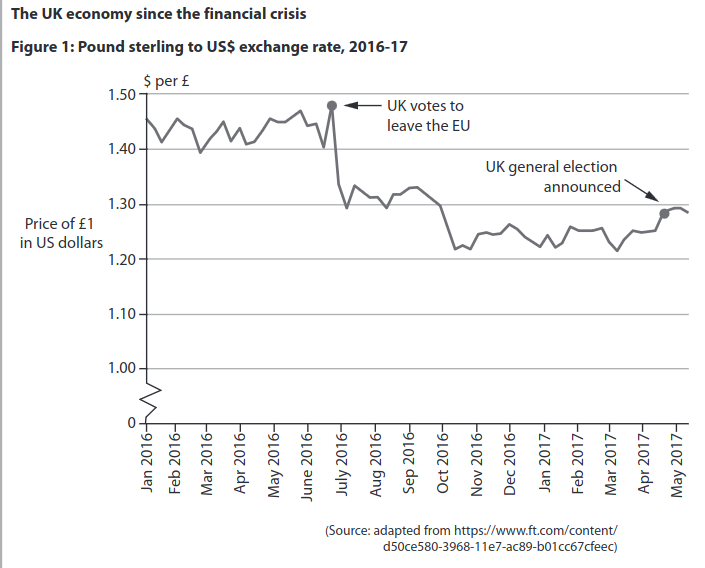

(b) With reference to Extract A and Figure 1, examine the likely impact of the change in the sterling exchange rate on the UK economy. (8 points)

(c) With reference to the last paragraph in Extract C, assess the impact of a fall in real incomes on subjective happiness. (10 points)

(d) With reference to Extract C, discuss the potential conflicts between macroeconomic objectives when the central bank attempts to control inflation. (12 points)

(e) Discuss whether providing substantial government financial support to banks is the best policy response during a financial crisis. (15 points)

Question 4: Edexcel A-Level Economics 9EC0 May 2019 Paper 2

Japan’s budget deficit for 2017/18 is expected to be 4.6% of GDP. Its national debt is forecast to increase to above 250% of GDP by 2019. Evaluate the impact of a large fiscal deficit and national debt on a country’s economy. (25 points)

Mark is an A-Level Economics tutor who has been teaching for 6 years. He holds a masters degree with distinction from the London School of Economics and an undergraduate degree from the University of Edinburgh.